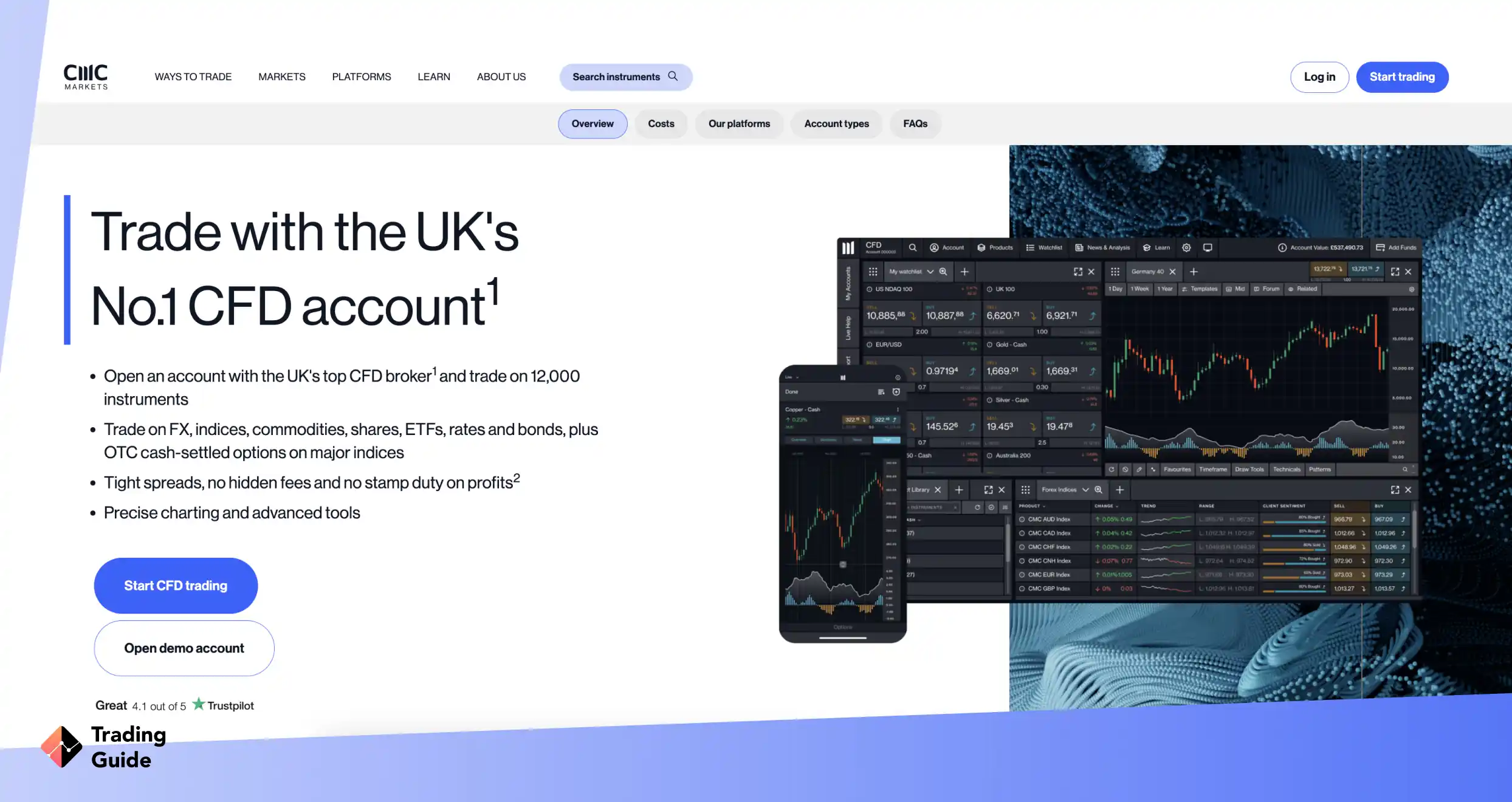

CMC Markets is a UK-based online brokerage offering Contracts for Differences (CFD), forex trading, and spread betting on a total of 11,000+ assets.

- Wide choice of assets – 10,000+ on several markets

- Licenced and regulated by the FCA and other regulatory bodies

- Suitable for beginners and experienced traders

- Good educational material to help you optimise your trading

- Commission on share CFDs

- Fees on some transactions

- Only OTC trading

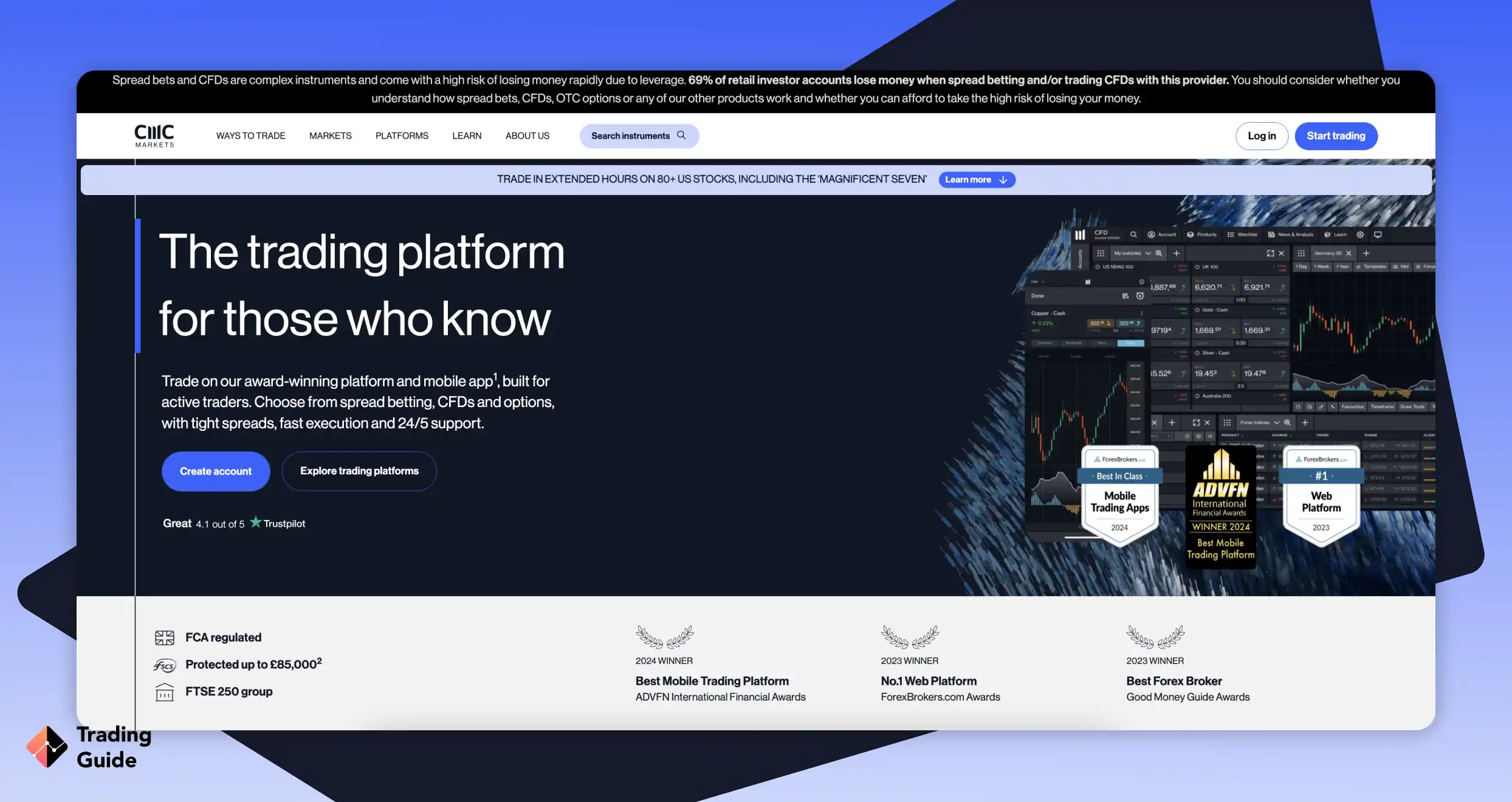

This broker has a great reputation in the industry and after a recent make-over, the award-winning platform has gotten even more efficient.

CMC Markets is Best Suited For

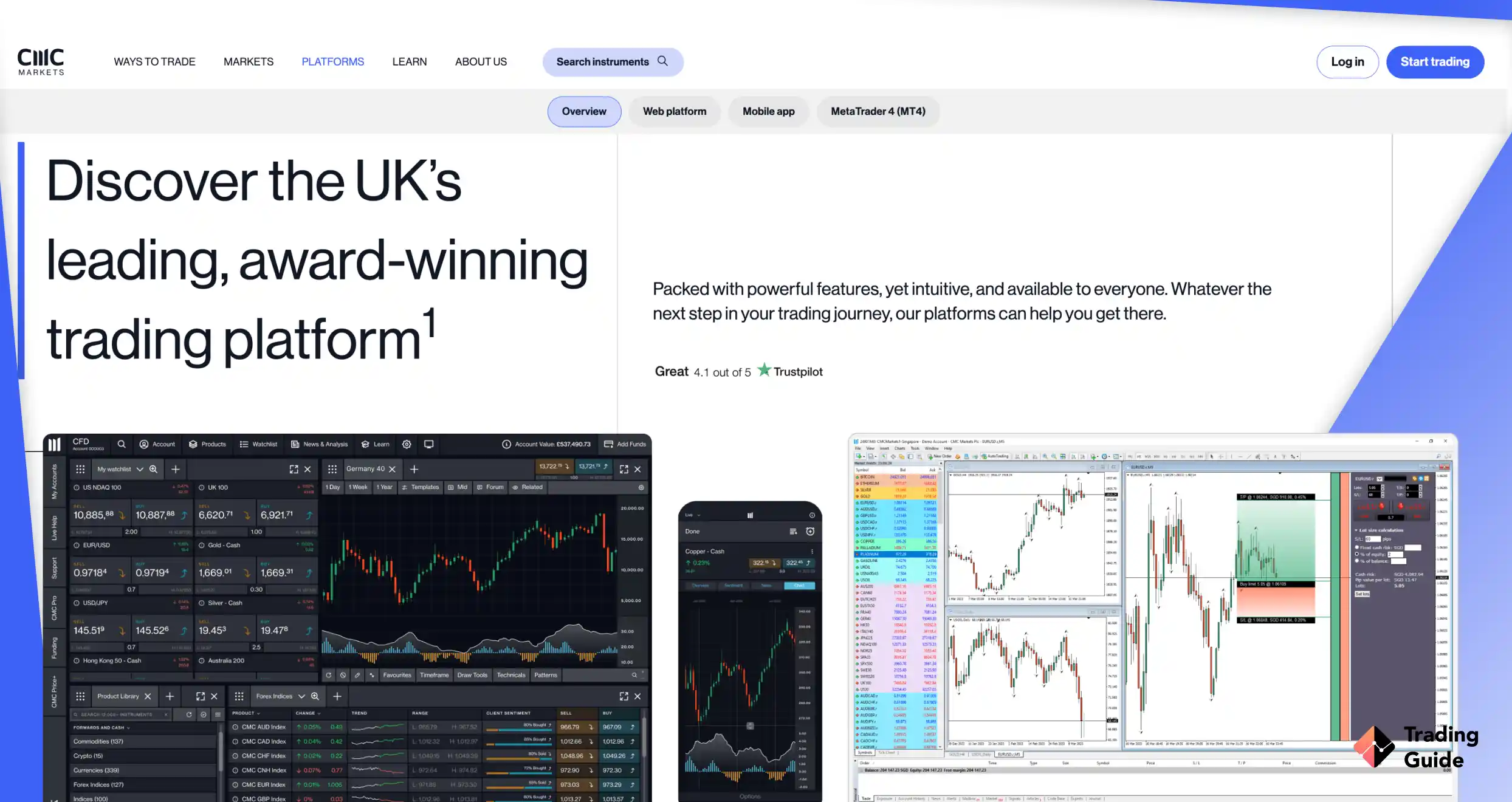

CMC Markets’ main market is the UK and it is based in London from where they offer forex trading, CFDs, and spread betting on thousands of assets in a range of markets. This broker is well-known for its amazing platforms and you have the option to pick between trading on the legendary MetaTrader 4 (MT4) or CMC’s adjustable Next Generation platform with some of the best graphs and tools in the business.

In our opinion, there is no doubt that CMC Markets is one of the best online stock brokers in the UK. With a selection of over 10,000 stocks on offer and an incredible platform for desktop and mobile trading, CMC Markets stands out from most of the competition. Never before has it felt so smooth to take positions on financial markets.

CMC Markets – Who Are They?

CMC Markets was founded in 1989, under the name Currency Management Corporation (CMC), and started offering online forex trading in 1996. This early launch helped make CMC Markets one of the first and subsequently oldest online forex brokers in the world.

Since then, the company has expanded, and even though world-class forex trading is still offered, CMC Markets has established itself as a great multi-asset broker for both stock traders and commodity investors alike, not to mention all the forex traders.

Today, the company boasts a wide customer-based which is divided into about 50% UK traders and 50% international traders. With headquarters in London, the broker’s main license is issued by the Financial Conduct Authority (FCA), although it is just one of many broker licenses that CMC has been issued.

Over the years, CMC Markets has been awarded a range of prestigious awards and recognitions. Some of the latest ones include:

- Best Spread Betting Provider (2021) at the City of London Wealth Management Awards.

- No.1 Web-based Platform awarded by ForexBrokers.com, also in 2021.

- The 2020 Best CFD Provider of the Year award at the Shares Award

Compare CMC Markets Features With Other Brokers

Compare brokers

Licences and Security

As always, our priority when testing a broker is safety. AS mentioned many times, we would never recommend or review an unlicensed broker that posed a potential threat to its customers. Because of this, we have become experts in trading laws and spend a lot of effort ensuring that each broker we test is, in fact, legitimate and trustworthy.

In some cases, as with CMC Markets, it is quite obvious that a broker is legally operating thanks to its reputation and history. Being the fact that CMC Markets is based in the UK, the license from FCA serves as their main license. However, as with most top-tier online brokers, CMC Markets has a range of other licenses and approvals from around the world.

- In the UK: regulated by the Financial Conduct Authority (FCA), under registration number 173730.

- In the EU: authorised and regulated by Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin), under registration number 154814.

- In Canada: CMC Markets Canada Inc. is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and a member of the Canadian Investor Protection Fund (CIPF).

- In Australia: CMC Markets operates with a license from the Australian Securities and Investment Commission (ASIC) under license AFSL No. 238054. and AFSL No. 246381.

- In Singapore: CMC Markets Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore (MAS) Reg. No./UEN 200605050E.

As you can see, this broker is legally available in some of the toughest jurisdictions around, even in Canada which is very unusual for European and British online brokers.

You might have also noticed that CMC Markets isn’t directly regulated by the CySEC which is the most common. Instead, CMC Markets has its European headquarters in Germany, thus they are also regulated by the German financial regulator (BaFin). This still means that CMC Markets operated under ESMA and European Union regulation.

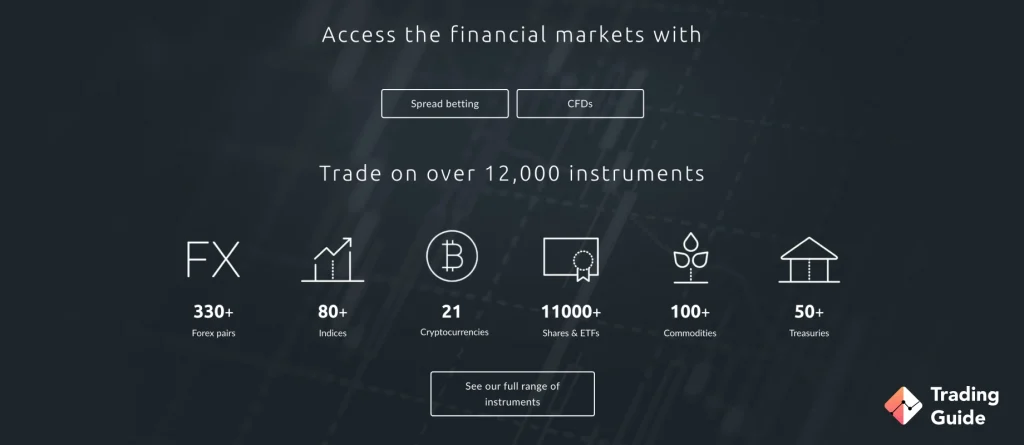

CMC Markets Assets and Markets

The most impressive feature of CMC Markets is the wide, international selection of assets on several attractive markets totaling 11,000 different financial instruments. Not only does CMC provide access to the stock and forex market, but you can also take positions on Exchange-Traded Funds (ETFs), treasuries, commodities, and share baskets.

Most of the available assets can be traded as CFDs or using spread betting. These two types of trading are very similar, yet different. CFD trading is considered more serious and is regulated as trading, while spread betting is more similar to regular betting. Hence, you don’t pay capital gains tax when spread betting with CMC Markets.

CMC Markets Fees, Commission, and Spread

Trading is never completely free and you should have a complete understanding of what you’re expected to pay a broker before you sign up. Because of this we always offer a breakdown of each broker’s general fees and average spread and/or commission.

Luckily, CMC is one of the more affordable brokers available on the UK market today.

The best thing with CMC Markets fees is that they don’t have a minimum deposit requirement like most other brokers do. This means that you can activate your trading account with any amount that you see fit. As a comparison, eToro and IG Markets have minimum deposit requirements of $100 and $300.

| Minimum Deposit | £0 |

Furthermore, CMC Markets is a commission-free broker and instead of commission they charge spread. The spread can vary greatly from asset to asset and market to market, which is why we can’t give you a full breakdown. However, this broker does have some of the tightest spread around, making it an affordable broker suitable to most traders regardless of budget.

You can also expect to be charged the regular non-trading fees such as overnight fees, inactivity fees, and exchange fees if making transactions in a non-supported base currency.

| Type | Fee |

|---|---|

| Inactivity fee | £10 monthly |

| Withdrawal fee | £0 |

| Deposit fee | £0 |

Deposit Methods and Supported Currencies

There are three ways in which one can fund a CMC trading account. They are among the most widely accepted payment methods in the world, making it easy to deposit and withdraw funds.

As per usual, all the main currencies are supported for deposits and withdrawals. In the UK, you naturally use GBP but can also choose USD or EUR, for example. If using another currency you will be subject to pay exchange rates and extra fees.

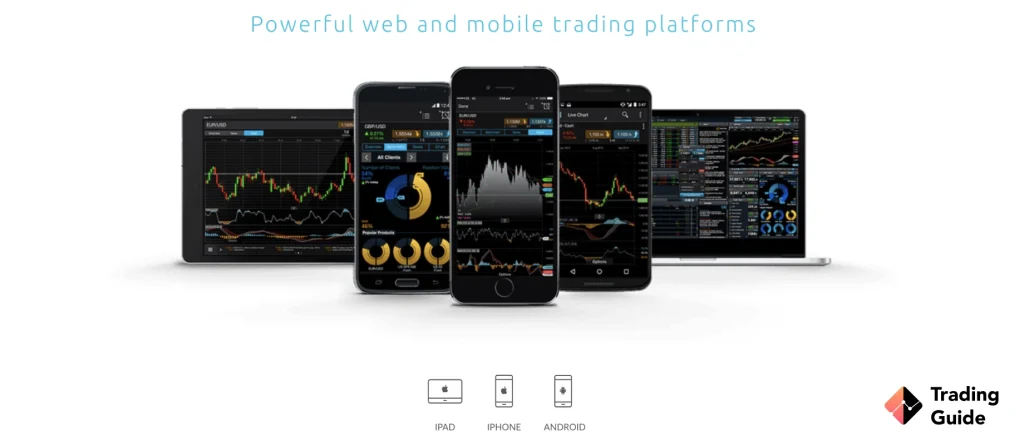

Platform and Research Tools

To keep things simple, CMC Markets only has two different trading platforms. Both of them are absolute world-class featuring every tool, graph, and piece of financial data you need. One of the platforms is designed for forex trading, while the other can be used for CFDs. Of course, both platforms are available in a web-based version and an app for iOS and Android.

How to Register a CMC Markets Account

If you are convinced that CMC Markets is the best broker for you, it’s time to sign up and register your trading account. This is a straightforward process that you can complete within a few hours as long as you’re prepared with the right documentation. This is because you have to verify your identity to trade legally.

Since all online brokers that we recommend are online brokers regulated by the FCA, they also follow the same regulations regarding customer protection and registration. Therefore, the process and the following steps are universal and can be used by any broker, whether that be CMC Market or any other stock, forex, or spread betting broker.

You first have to visit CMC Market’s website. Even though you can register an account on a smartphone, we suggest that you do it using a computer because it makes things more simple and you have to download an app to your phone. Once you’ve registered, you can access your account on any device.

Similar to registering an online bank account or any other type of online service account, you initiate the registration by providing personal information which you will have to verify, so ensure that it’s correct. You’ll be asked to provide your full name, date of birth, address, phone number, and email address, among other information.

CMC Markets will also ask questions regarding your income and you will have to prove your knowledge of financial markets by answering a couple of questions. This is done to protect you from unnecessary risk by setting a leverage and margin level that suits your skillset.

According to Financial Conduct Authority (FCA) regulation, you also have to verify your identity and residence by submitting documentation to CMC Markets.

To do this, you need to submit two documents: a copy of your ID to prove your identity and a recent utility bill or bank statement to prove your residence. Once this information has been submitted, it will be manually verified by the broker before your account is activated.

You can open a CMC Markets demo account before you verify yourself. That way you can make sure that you like the platform and broker before committing to it.

The last step before your account is fully activated involves you making your first deposit to your trading account. As mentioned before, CMC Markets is one of the few online brokers that have no minimum deposit requirement. This is so that you and all the other traders can make a first deposit that suits them and their plan, and not the brokers.

When using other brokers, these levels can range from anywhere between £0 to £500+.

After you have created your account, verified your identity and residence, and made an initial deposit, you’re ready to get started with CMC Markets. At this point, you will have full access to your trading account and all the features and tools you need to analyze markets and place profitable trades.

If you’ve never traded before, you should make use of all the incredible educational material provided by CMC Markets. You will be surprised by how much you can learn from your broker, and CMC really excels at trading education.

Editor’s Note

We find CMC Markets to be a great trading platform for both beginners and experienced traders looking for a varied and exciting trading experience with one of the world’s best online brokers. There are more than 10,000 assets on a range of markets, including assets that are created and exclusively offered by CMC Markets.

This broker is constantly developing and expanding, ensuring that the trading experience provided to you is always the best available. And despite the modern platforms and exclusive tools, CMC Markets remain an affordable broker suitable to budget traders as well as more sophisticated day traders.

The only downside with CMC Markets is transparency. Not that it’s a dishonest broker, but the website has been designed in a way that makes it difficult to find some information. Also, the customer service is not the most efficient and we’ve experienced long waiting times.

FAQs

CMC Markets was founded by Peter Cruddas in 1989 as a forex broker. It is a publicly-traded company listed on the London Stock Exchange (LSE). Cruddas owns a majority stake in the business.

Yes. CMC is one of the best online stock brokers in the UK. This broker has won a range of prestigious awards and recognitions for the services offered to its clients. It offers a wide selection of assets with an array of trading tools, low trading fees, and dedicated customer service.

Absolutely. CMC is a safe and trustworthy broker. It is fully regulated and follows the guidelines of several top-tier authorities including the Financial Conduct Authority (FCA) and CySEC. Therefore, you can rest assured that CMC will keep your money and personal information protected.

Yes. CMC is a really good platform for day trading and other short-term strategies. Day traders can use its groundbreaking copy and social trading features to integrate with other traders and share knowledge. CMC is also a great broker for long-term strategies, especially in stocks.

Yes. You can trade cryptocurrencies with CMC Markets via a spread bet or CFD account. Note that over 20 cryptos are offered, including Bitcoin and other altcoins.

- Follow the links provided in this review

- Create your Basic account

- Deposit to complete the process

- Start Trading with CMC Markets

This is the best trading platform I have ever used, the platform is very user-friendly, the trade execution is very simple and transparent. The only improvement required is to add a tool to compare the prices of two or more instruments at the same time.

In my opinion, one of the best brokers in the UK is CMC Markets. Trading with them for a year and really the best condition that one can get with regulated brokers.

- Low commissions

- Tight spreads

- Quick and hassle-free withdrawals

- No lag in order placement

- Live chat facility makes things handy.

I think these features are saying it all!

Initially, when I started my trading journey, I opened my demo a/c with CMC Markets since it's best suited for small investors like me. The app is very simple, easy to use and understand, and without needing any middleman thus saving our money on brokerage. I am highly satisfied with the app features, its pricing, charges, and other services. It's a one-stop solution for all investment and trading needs. Highly recommended!

As you see, this broker offers the trading platform MT4 that many traders find perfect. It is very functional and even support customized indicators. But I prefer a brokers with MT5 because is an improved version of MT4. What distinguishes it from its predecessor is the availability of a greater number of timeframes. It allows analyzing the market more correctly. Besides this, it comes with the depth of the market feature.

Forex trading has become my source of money. This is great because I can be free. I trade with an CMC Markets. This company does not have complex software. Here is Metatrader 4. This is a standard trading platform. I have enjoyed trading here since I opened an CMC Markets demo account. I liked the fact that you can use any time of the day or night. At first I had a job and I traded. It was convenient to study on a demo account, because the Forex market is open 24 hours a day. CMC Markets allows hedging, so I trusted this broker and didn't worry about losses. I know that not all brokers provide such opportunities and therefore I appreciate what I have.

Broker offers top-knots Metatrader4 Mobile trading platform. One account with good conditions - that is also a plus, and the rates are all quite transparent. I have not found any disadvantages of CMC Markets yet or maybe I just haven't found them in a half of year. Who knows? The only thing I miss for trading here is Metatrader5, after all, the fifth version has some desired features.

I have been a customer of CMC Markets for about 5 years. It's a very good platform with fast support and results. I work with several other brokers for comparison, but CMC is currently in the top three.

Great company with a very good trading platform with lots of clear and user friendly features to help make a professional or small trader confident in dealing in the markets of choice. Good customer services, offering a good amount of products.

Brilliant platform, easy to use, once shown and detailed; with clear instructions and efficient and effective trading tools. The expertise and knowledge on the markets and strategies was sublime and very engaging. Highly recommend it!

Great platform for trading. It is user-friendly. I feel confident with relevant tools at my disposal when taking a trade. They have competitive spreads. I like it so much

Platform fine and spreads much tighter than IG markets. They have a demo account to try, it is a really good option. I feel confident with relevant tools at my disposal when taking a trade. Comprehensive interface with wide range access to markets. I am really content.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Fees

Account opening

Customer service

Deposit and withdrawal

CMC Markets has won me over with its proprietary platform that's surprisingly intuitive yet packed with professional-grade tools and analytics